nj property tax relief for veterans

1-888-238-1233 or visit the webpage. 2021 Annual Tax Collectors Report PDF 2021 Tax Rate PDF 2021 Tax Rate Data PDF Contact Us.

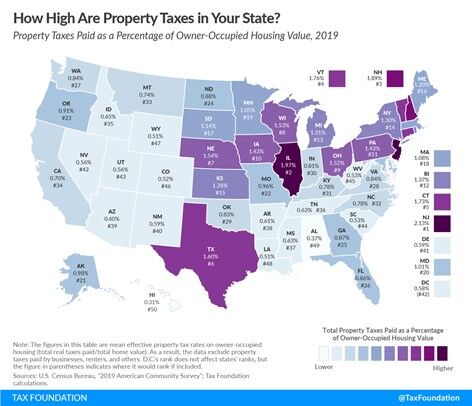

Property Taxes Calculating State Differences How To Pay

Be a legal resident of New Jersey.

. Request for a Letter of Property Tax Relief Ineligibility Out-of-State Residents. Annual Deduction for Veterans. State of new jersey property tax relief programs.

Property Tax Relief Programs. New Jersey Property Tax Relief Programs. For more information please contact the Assessment.

Initial Statement of Non-Profit Organization. Five Deductions are allowed by NJ State Statutes. Claim For Property Tax Exemption For Automatic Fire Suppression Systems.

Annual Property Tax Deduction for Veterans. For more information phone. 1 Kings Highway Middletown NJ 07748.

Property Tax Relief Programs. Have active duty service in the United States Armed Forces with an. APPLICATION FILING PERIOD File this form with the municipal tax assessor from October 1 through December 31 of the pretax year ie the year prior to the calendar tax year or with the municipal tax collector from January 1 through December 31 of the calendar tax year.

Full Property Tax Exemption for 100 Percent Disabled Veterans or Surviving Spouses PDF Property Tax Deduction Claim by Veteran. Certification for loss in Assessed Value of vacant land reported by Tax Assessor and certification by County Tax Board of aggregate decline in True Value due to Highlands Water Protection Act PL. Other Property Tax Benefits Senior Citizens Disabled Persons and Veterans Deduction Documents.

Property owners who are permanently disabled senior citizens or veterans may qualify for property tax deductions if they meet income and residency requirements. Wherever your property taxes fall in that range the NJ homestead rebate program is intended to provide property tax relief for eligible New Jersey homeowners. Information regarding application forms and qualifications may be obtained by contacting the Tax Assessors Office andor viewing the Assessors WebPages.

Wwwstatenjus Property Tax Relief All property tax relief program information provided here is based on current law and is subject to change. 2022 District-wide Annual Reassessment. Annual deduction of up to 250 from taxes due on the real or personal property of qualified war veterans and their unmarried surviving spousessurviving civil union partnerssurviving domestic partners.

Lynch CTA Tax Assessor Raymond Hall CTA Deputy Tax Assessor John Kern Principal Assessing Clerk Property Inspector Ronald Da Silva Property Inspector Senior Clerk Gina Girgenti Assessing Clerk Our office hours are from 830 am. Military pay is taxable for New Jersey residents including combat zone pay received in 2020 and prior. The State of NJ site may contain optional links information services andor content from other websites operated by third parties that are provided as a convenience such as Google Translate.

The law excludes military pay for service in a combat zone or for hospitalization as the result of injury while serving in a. With respect to the 250 Veterans Property Tax Deduction the pretax year is October 1 2020 with the deduction applied to the property taxes for Calendar Year 2021. Lets look at how the program typically works.

Direct appeals to the NJ State Tax Court can only be filed if the assessment exceeds 1000000. NJ 400 Witherspoon Street Princeton NJ 08540 Phone. For example for a property tax deduction claimed for calendar tax year.

For Tax Year 2021 and forward combat pay is not taxable in New Jersey PL. Military and Veteran Tax Benefits New for 2021 - Income Tax. Property Tax Relief Programs.

Monday - Friday 8 am. Senior Citizens Surviving Spouses of Qualified Senior Citizens Veterans Veterans WidowsWidowers and Disabled Persons. For information on the Property Tax Reimbursement Program available to eligible New Jersey residents 65 years of age or older go to https.

For your convenience property tax forms are available online at our Virtual Property Tax Form Center. To qualify as of October 1 of the pretax year you must. The lowest average amount was in Camden where average home values of 56763 played out with property tax bills averaging 1728.

Annual deduction of up to 250 from taxes due on the real or personal property of qualified war veterans and their unmarried surviving spousessurviving civil union partnerssurviving domestic partners. A tax appeal is an appeal of your tax assessment compared to the.

How Property Tax Rates Vary Across And Within Counties Eye On Housing

New Property Tax Relief Program Would Assist 1 8m Nj Homeowners Renters Njbiz

Governor Phil Murphy Tax Relief Is A Critical Component Of A Stronger And Fairer New Jersey With Middle Class Tax Rebates An Expansion Of Our Earned Income Tax Credit The Long Overdue Updating

States With Property Tax Exemptions For Veterans R Veterans

I Also Have Friends Who Dont Have To Pay Property Tax After Getting Medical Disability Does Fox News Want This To Go Away R Military

Nj Property Tax Relief Program Updates Access Wealth

Township Of Scotch Plains Nj Scotch Plains Council Calls On State To Restore Property Tax Relief Fund

Understanding The New Jersey Freeze Act And Your Property Taxes

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania

Veteran Tax Exemptions By State

N J Now Has 2b In Property Tax Relief What You Need To Know And How To Get Your Rebates Nj Com

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania

Property Tax Relief I Ve Got A Proposition For You Governor Mulshine Nj Com

Op Ed Truth In Taxation Is Necessary For Iowa Property Tax Relief Iowa Thecentersquare Com

Property Taxes Calculating State Differences How To Pay

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

Tax Assessment And Collection News Announcements West Amwell Nj

/PropertyTaxExemptions-5abfea720b6f4b048a2e654e286d7230.jpeg)